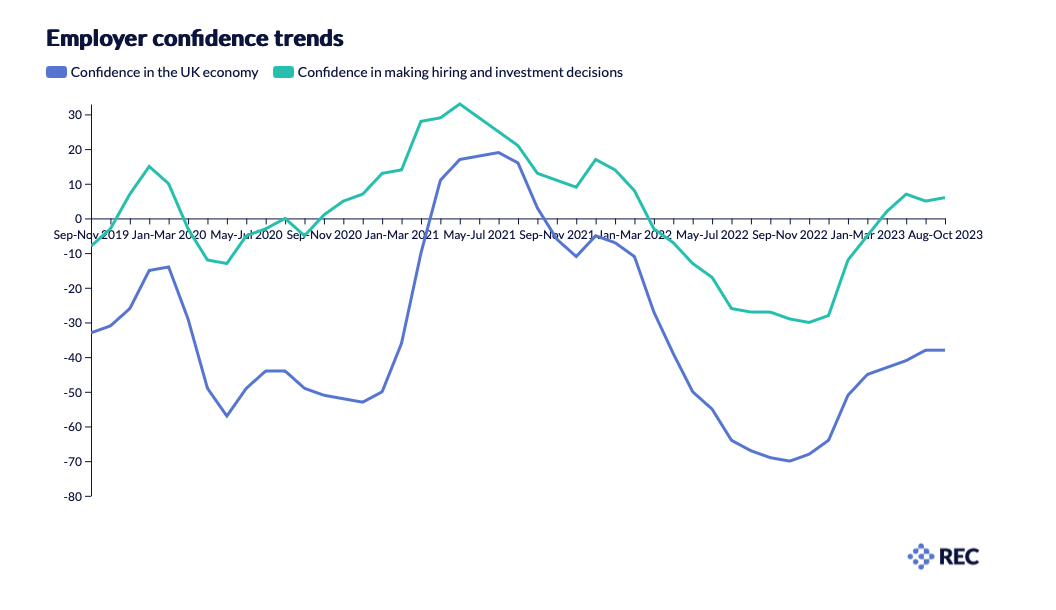

As the UK approaches 2024, there’s a positive trend in employer confidence towards investment and recruitment within their firms, showing an upward trajectory each month. This trend aligns with the efforts of policymakers focused on stimulating business investments to fuel economic growth, and the current data suggests that businesses should embrace the Autumn Statement initiatives.

However, this optimism stands against a backdrop of wider economic concerns, indicating a divide between the business sector’s perception of the economy and their operational realities. Businesses are exhibiting much more optimism about their future than they were a year ago, with increased confidence in investment and recruitment pointing to potential improvements in performance. However, it’s prudent to temper expectations for a rapid economic rebound. It is anticipated that the gradual progress being observed will require several months to significantly impact the economy, as evidenced by current firm sentiments about economic prospects.

Diminished business assurance in the larger economic scene, coupled with subdued consumer expectations, underscores the significance of the Chancellor’s supportive measures for businesses announced in the Autumn Statement. To truly elevate the economy, these measures must be underpinned by a robust growth strategy. Now, the focus is shifting to the upcoming Spring Budget, where employers are hoping for a comprehensive industrial strategy. Recent developments, such as Nissan’s investment in Sunderland, illustrate the substantial impact that a synergistic approach to regulation, research and development, workforce skills, and decentralization can have on economic vitality.

Statistics from the Office for National Statistics

Unemployment Rate

The most recent statistics from the Office for National Statistics Labour Market Overview for November 2023 indicate that the UK’s employment rate for the period from July to September 2023 was approximately 75.7%, a slight decrease of 0.1 percentage points from the previous quarter.

According to the Bank of England’s November Monetary Report, the unemployment rate is expected to stabilize at 4.7% by the end of 2024. Following this period, the unemployment rate is anticipated to increase to around 5.1% by the fourth quarter of 2026.

GDP

The latest data from the Office for National Statistics’ GDP monthly estimate for the UK in September 2023 reports that:

- The monthly real GDP saw a growth of 0.2% in September 2023. This comes after an increase of 0.1% in August 2023, which has been adjusted from an initially reported 0.2% growth.

Future projections are as follows:

- GDP is anticipated to decline throughout 2023, potentially reaching as low as 0.4% in 2025. However, a recovery is expected with GDP growth forecasted to rise to around 1.1% by the fourth quarter of 2026, according to the Bank of England’s November Monetary Report.

- The GDP growth rate for 2023 is estimated to be a modest 0.5%, with an increase to 0.6% in 2024. The combination of lower energy costs and a slackening economy is predicted to drive down headline inflation to approximately 5.25% by the end of 2023, reaching the target of 2% by mid-2025, as projected by the International Monetary Fund in its October 2023 report.

CPI inflation

The latest information from the Office for National Statistics regarding consumer price inflation in the UK for October 2023 indicates that:

- The Consumer Prices Index (CPI) increased by 4.6% in the year leading up to October 2023, which is a decrease from the 6.7% rise noted in September.

- In the same period, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) went up by 4.7%, a drop from September’s 6.3%.

According to the projections from the Office for Budget Responsibility’s Forecast evaluation report from October 2023:

- The surge in energy costs has exerted a more significant influence on CPI inflation than was initially expected. Coupled with the lingering effects of the pandemic on global supply chains, this led to an unforeseen spike in inflation, reaching a high of 11.1% in October 2022. Subsequently, inflation decreased to 6.7% in August 2023 as the external pressures causing inflation began to ease.

The Current Job Market

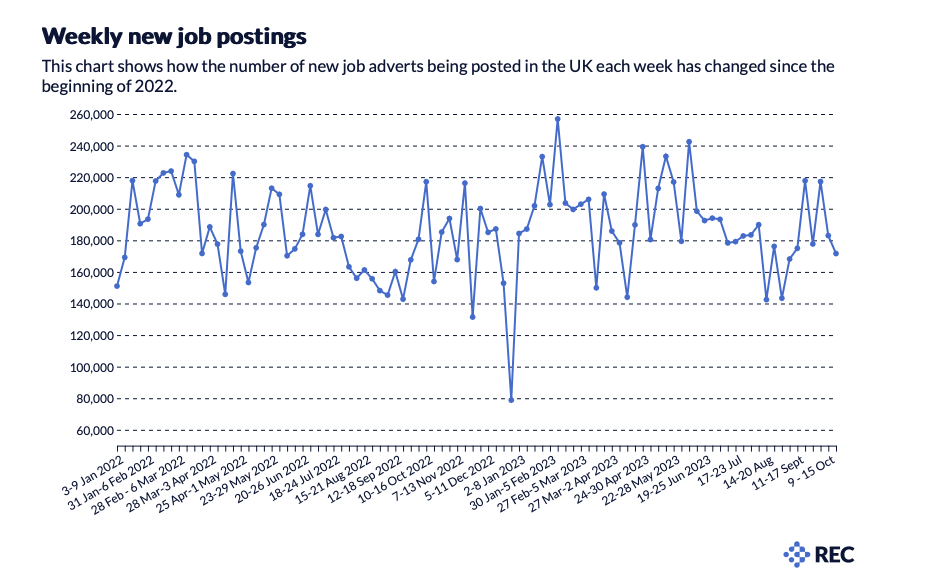

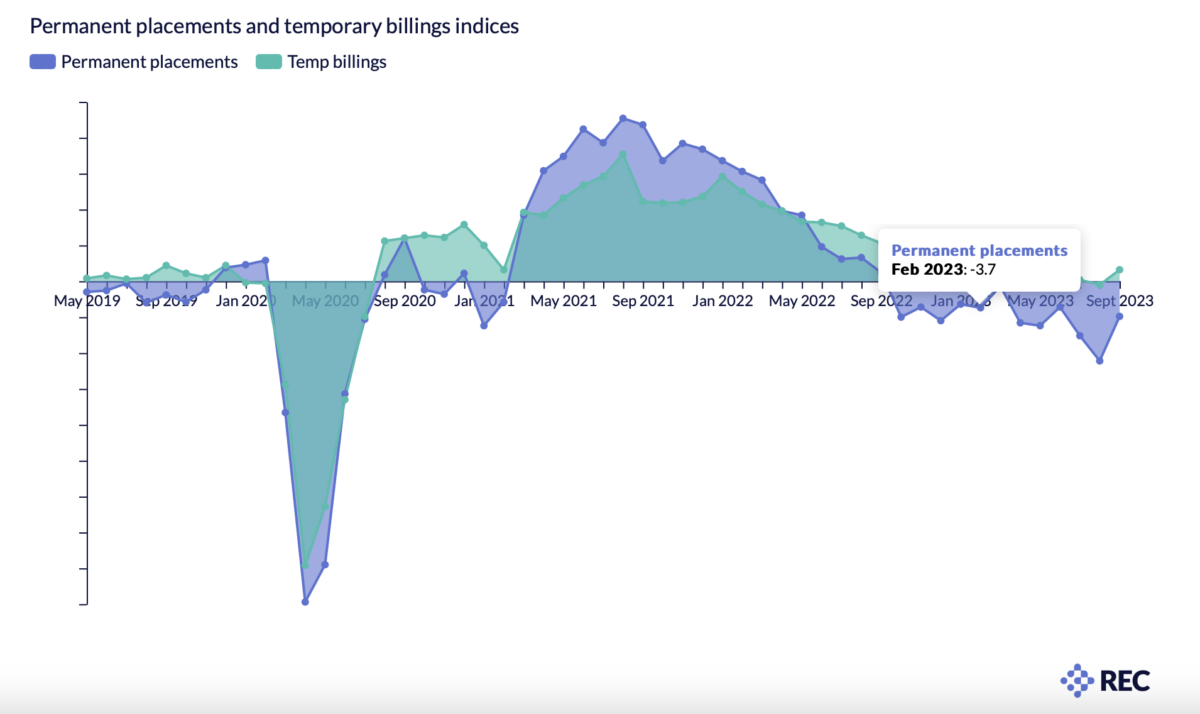

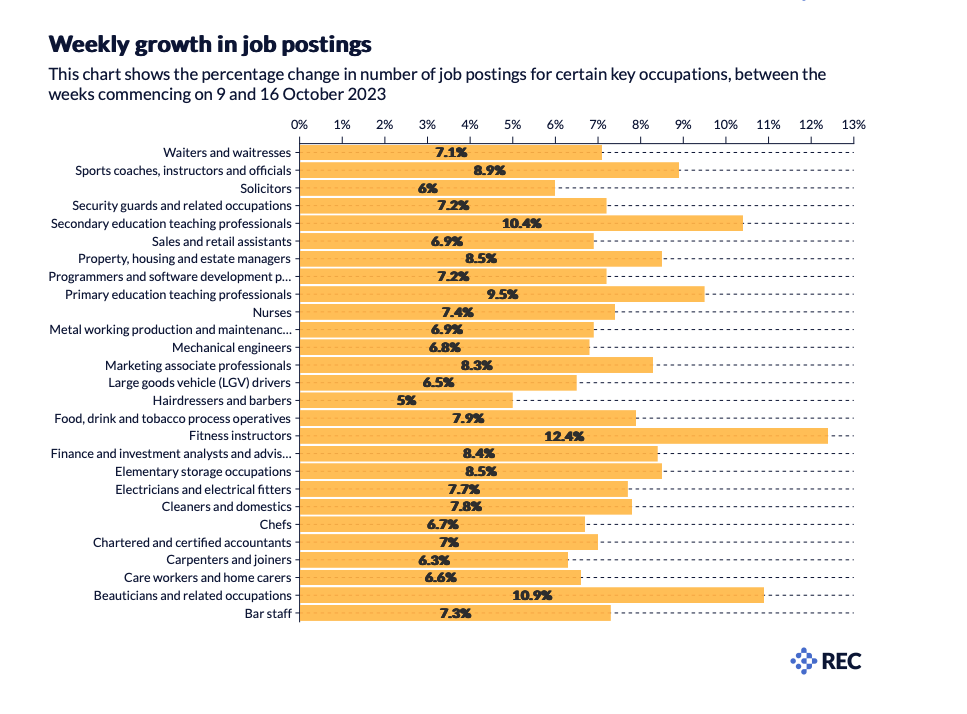

The latest data suggests a sustained but softened demand in the job market compared to last year, yet job vacancies are still surpassing pre-pandemic levels. The current landscape is complex; sectors such as hospitality and healthcare are faring better in terms of temporary roles compared to permanent positions, with IT and construction jobs also showing resilience. The pay increase continues, albeit primarily as a result of employer-initiated wage awards aimed at assisting employees with the cost of living, rather than as a consequence of competition for labour.

Key points

- Softer, but sustained fall in permanent staff appointments

- Temp billings rise for the second straight month

- Candidate availability expands at a sharper pace

Permanent job placements experienced the smallest decrease since June as cautious hiring continued throughout the UK in October. Economic uncertainty led to a slowdown in hiring for permanent roles for the thirteenth consecutive month, but the decline was the most modest since June. Concurrently, there was a notable increase in temporary job billings, indicating a preference among some employers for the adaptability of short-term hires in the prevailing economic environment.

Candidate availability saw a significant uptick for the eighth consecutive month in October, surpassing the rate of increase seen in September. This surge was primarily due to a faster rise in the number of candidates for permanent positions, although the supply of temporary staff also grew robustly. Reports suggest that the increase in available candidates was largely due to job cuts and restrained hiring activities.

Growth in starting salaries for permanent positions continued to rise but at the slowest pace in over thirty-one months. Despite this deceleration, salary inflation remained pronounced, aligning with the long-term average for the series. Recruitment agencies frequently noted that in order to attract and retain adequately skilled workers, employers had to offer higher salaries, reflecting the increased cost of living.

Overall, the demand for staff reached a point of stability in October following a slight dip in September. Detailed data revealed that permanent job vacancies saw only a marginal decrease, while temporary positions observed a moderate increase. However, the demand for temporary staff showed the second smallest rise since January 2021.

A robust growth strategy for the UK must leverage the skills and productivity of its workforce. Enhancements in areas such as skills development, transitioning from welfare to work, infrastructure, transportation, and taxation will be crucial to bolster labour market engagement. Should the current labour shortages remain unaddressed, it’s projected that there will be a downturn of 1.2% in the expected GDP by 2027. The economic impact of this could amount to an annual loss of between £30 billion and £39 billion. (REC)

The Autumn Statement

On 22 November 2023, the chancellor of the exchequer delivered the Autumn Statement during which he made several announcements that will likely impact many REC members. These include the following:

- Employee national insurance contributions – The main 12% of employee national insurance contributions will be cut two percentage points to 10%, taking effect from the 6th of January 2024.

- Employee pension – The introduction of a “pension pot for life scheme” which will give workers the option to nominate the pension fund that their employer pays into, allowing workers to benefit from one pension pot throughout their working lives.

- IR35 set-offs – Following the consultation earlier this year which the REC responded to on behalf of our members, new legislation regarding IR35 set-offs will come into effect from 6 April 2024. This will enable HMRC to make regulations to allow it to set off taxes already paid by workers and their intermediaries against the PAYE liability of a deemed employer. These regulations can only be laid once the Finance Bill becomes law and this is not expected until sometime in the New Year.

- Fit notes – The fit note regime will be overhauled with a focus on the treatment required as opposed to the time off a worker needs.

The Chancellor’s agenda emphasized reducing national debt, tax cuts, and incentives for businesses, reviving the ‘levelling up’ strategy previously put on the back burner by his predecessor. The statement included several business-friendly points, there were measures introduced aimed at aiding clients, with the anticipation that these will translate into increased workforce demand.

Back to Work plan

The Chancellor has proactively disclosed key initiatives, notably extending the Restart Scheme for two more years, signalling a commitment to support job seekers. He has recognized the need for improved aid to help more people secure employment, along with implementing stricter penalties for those who do not actively engage with employment services. Maintaining equilibrium is essential: it’s about providing genuine support for job seekers while ensuring accountability for those not taking full advantage of job centre resources or not receiving proper support from the employment system or work coaches.

To credibly enhance productivity, a holistic workforce strategy is imperative—one that addresses the complexities of our labour market’s human resource issues. Equally urgent is the reform of the Apprenticeship Levy. Merely increasing the number of apprentices in engineering and burgeoning sectors is not enough. Meaningful changes to the Apprenticeship Levy are necessary to effectively tackle labour shortages, combat economic inactivity, and invigorate business investments.

As we close this month’s update, let’s embrace the steps taken and the journey ahead. The Chancellor’s Back to Work plan marks a strategic pivot in our approach to employment, intertwining the necessity of support with the virtue of responsibility. As we reform and refine initiatives like the Restart Scheme and the Apprenticeship Levy, we stand at the cusp of shaping a workforce as resilient as it is skilled.

We invite every stakeholder to partake in this transformative phase — whether by contributing to policy discussions, engaging with job centres, or supporting apprenticeships in critical sectors. Together, we can cultivate a labour market robust enough to withstand challenges and flexible enough to seize opportunities.

Thank you for your continued support and engagement. Until my next update, let us all commit to the shared goal of enhancing productivity and employment with unwavering resolve and collective effort.

To your continued success,

Leena Parmar

Founder, Citrus Connect Recruitment